Continuing my 2020 Platform series, I thought I’d tackle the federal budget. A difficult topic, you say? No, not really. As Trump likely said to Stormy, no matter what you do, you just can’t make this hard.

While no one in Washington appears to have ever balanced a checkbook, the rest of us understand the basics of managing to a budget.

We start with our account balance which tells us how much money we have or, conversely, how much we’re in debt. We then compare our expenses against our income, taking into consideration the necessary reduction of any outstanding debt. If the resultant budget says we’re spending more than we’re bringing in, we either need to spend less or make more.

Cool. So we’re done here, right?

Well, we damn well should be!

Sure, sure. Macro economic theory tells us that the federal government should increase spending during economic downturns and reduce spending when the economy recovers. While that may seem counter-intuitive at first, it’s really no different than an individual taking out a student loan to get a better job and then using some of the additional salary to pay off the loan. Simple.

Let’s break it down.

The Federal Deficit

I’ll start with the elephant in the room. Seriously. The elephant.

Republicans spent the entirety of the Obama administration whining incessantly about the rising deficit.

To be sure, while the U.S. had been running in the red since before WWII, the Obama administration made it worse. Obama’s deficit spending (including a massive bipartisan stimulus package) was intentional and necessary to drive the economy through the financial crisis that hit the nation at the end of the Bush administration.

Still, the federal deficit was at almost $20 trillion when Obama left office. TWENTY TRILLION. A $20 trillion stack of $5 bills would stretch well past the moon. Folks, that’s real money. The Republicans were right. The deficit was obviously a serious problem worthy of immediate action. Since the economy was recovering nicely, it was time to start paying down the debt.

However, once in control, Trump & Company promptly changed their minds. They passed substantial federal tax cuts that helped corporations and the rich. Concurrently, the GOP-led government also dramatically increased federal spending. Lo and behold, with less income and more expenses, the federal deficit continued to rise. Imagine that!

The deficit surpassed $22 trillion in February of this year. For those keeping score, that’s a 10% increase in just two years of Trump with no plans whatsoever to reverse the trend. Current CBO projections put the deficit at around $34 trillion by 2029.

Some might thus call Republican lawmakers hypocrites. I have another word in mind.

Federal Spending

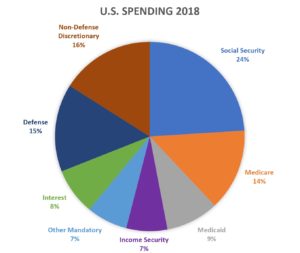

I searched online for a graphic with a decent high-level breakdown of current federal spending but eventually settled on creating my own, summarizing raw CBO data.

“Income Security” includes unemployment insurance, SNAP (food stamps), child nutrition programs, etc.. “Other Mandatory” includes federal retirement benefits (military & civilian), veterans programs, etc.

In 2018, our federal spending totaled $4.1 trillion.

It is first worth noting that 8% of that is just interest on our debt. That’s $328 billion in just one year that bought us absolutely nothing. Zilch. Even worse, as anyone who has tried paying only the minimum monthly amount on a credit card knows, debt maintenance quickly gets worse over time. As our deficit grows, our interest payment grows. It’s not a pleasant trend.

The social safety nets and the military consume the lion’s share of our national budget and they each deserve their own blog posts. My brief take here is that these are absolutely essential elements of our government and our national identity. Can we improve on them and make them more efficient? Of course we can. But we are the leaders of the free world and we take care of our own. These should be points of national pride and not something for which we should ever apologize.

We’re thus left with 16% of our budget for the “Non-Defense Discretionary” spending that pays for everything else in our massive governmental alphabet soup (IRS, CBP, FBI, CIA, TSA, FHWA, EPA, NASA, FEMA, NPS, USDA, FDA, NIH, DOE, FCC, SEC, HUD, USPS, etc., etc., etc.).

Sure, this is “discretionary” spending and we could certainly choose not to fund any of these agencies. Think about that for a moment, though. Only 16 cents out of every tax dollar funds what most people think of as “The Government”. I contend that the vast majority of people across the political spectrum would agree, in isolation, that the vast majority of these agencies are rather necessary to our way of life. Are there some expenses that mostly appeal to one party or the other? Sure. Could we be more efficient across the board? Always. But if anyone thinks that minor cuts or tweaks here and there will save more than a penny on the dollar at best, I would love to see the math.

Federal Income

My homeowners’ association wants a ton of improvements to our jointly owned property and simultaneously complains that our HOA fees are too high. I get it. Everyone wants something for nothing. Free is great! The problem is that stuff ain’t free. No one likes paying taxes but government services also aren’t free.

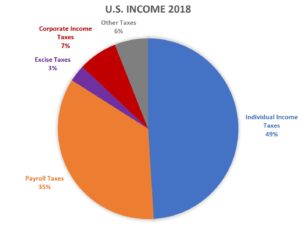

Here’s my high-level breakdown of federal income:

“Other Taxes” includes estate taxes, gift taxes, etc.

In 2018, our federal income totaled $3.3 trillion. You might have noticed that this is $800 billion less than we spent. Hence, the problem.

In general, a free market with robust competition will provide, over time, the best economic motivation for greater innovation, higher quality, and lower costs. The resultant strong economy will increase the tax base (both individual and corporate) and thus increase government revenue at reasonable tax rates. The government’s economic roles are to (a) set reasonable tax rates to pay for the services that the public needs/wants, (b) maintain a fair environment, and (c) encourage/discourage market behaviors that may impact society for better/worse. Unfortunately, our government sucks at every one of these tasks.

The recent Republican tax cuts might have been okay had they had been better targeted and hadn’t increased the federal deficit quite so much. There were zero economic reasons for the tax cuts to be so huge; that was pure politics. Smaller tax cuts would have garnered bipartisan support and might have allowed us to at least start to address debt reduction. But no. The tax cuts were instead implemented at the literal expense of our long-term national financial stability.

Democrats aren’t immune to fiscal stupidity, either. The left’s recent calls to just raise tax rates on the rich makes for great political sound bites, but doesn’t solve the problem. Most well-off Americans already pay a ton of taxes. In 2018, the top 20% of tax filers received 53% of all pre-tax income and paid 68% of all federal taxes; the top 1% received 16% of all pre-tax income and paid 26% of all federal taxes. So how about the uber-rich? While that’s a valid issue, it won’t be addressed by merely increasing upper income tax rates. These folks can just hire whole floors of accountants to game our massively complex tax code and avoid the declaration of any taxable income at all. There isn’t a lot of difference between 37% of zero and 70% of zero. One of the many likely reasons Trump wants to keep his tax returns private is that he hasn’t paid any income taxes in decades.

While often overlooked, economic incentives and disincentives (largely in the form of excise taxes, tax credits, and tax deductions) are extremely important parts of the federal income equation.

Federal excise taxes are implemented on some items, but such taxes account for only 3% of federal income. On the flip side, there are a ton of tax give-aways that not only don’t help matters – they make matters much worse.

Ethanol is just one representative example. U.S. taxpayers have to make up for over $7 billion in annual tax credits that the government grants to Ethanol producers. Ethanol is a low-quality biofuel which various levels of governments mandate be blended into gasoline. Since about 40% of U.S. corn is used to create Ethanol, consumers also have to pay more for edible corn and other corn-based food products. Furthermore, since Ethanol-laced gasoline is less efficient that pure gasoline, consumers also have to buy more of the blended gas to get equivalent mileage. So who exactly benefits here? Iowa. Iowa is the top corn-producing state in the U.S. and just so happens to be the first stop during the political primary season. Strange coincidence, huh?

Our income problem boils down to this: There is little political upside to raising taxes, simplifying the tax code, or reworking tax incentives. Politicians are unfortunately motivated to spend every dime they can get their hands on to get elected and re-elected for as long as they can. They are more than content to let future politicians and future generations deal with the debt they create. They simply don’t see the deficit as their problem and, when their primary goal is re-election, they are sadly correct. It’s not just their fault; it’s ours.

Suggestions

Future blog posts may well expand on some of these thoughts, but here’s just a few budget-related suggestions:

Implement Federal Term-Limits: Addressing the federal deficit will require political courage. Unfortunately, courage will never be in large supply among career politicians. Voters might respect a candidate that says “I will raise your taxes and take away your favorite tax incentives” but that respect won’t equate to actual votes. Term-limits won’t completely solve this problem, but they can’t hurt. Elected officials are often more inclined to do the right thing when they’re not up for re-election.

Eliminate the Legislative Debt Ceiling: Trying to control the deficit with an artificial “debt ceiling” is laughable and this political football just needs to go away. The deficit is money we’ve already spent. We can’t just put the kitchen sink on our national credit card and then not pay the bill. I tried that in college. It didn’t work well.

End Government Shutdowns: Politicians need to stop shutting down the government when they can’t agree on spending bills. Here’s a thought. When the government shuts itself down, the folks that cause the shutdown don’t get paid. This group would include every single federally-elected officeholder, all federal political appointees, and all of their senior staffs. Importantly, this group of people would NEVER receive any back pay when the government inevitably reopens. This only seems fair and I guarantee that it would eliminate all future shutdowns.

Simplify the Tax Code: Our tax code is way too complex. Significant tax revisions would be required to ensure that everyone, including the uber-rich, pays their “fair share” of taxes. In 1913, the U.S. tax code was 27 pages. It’s now over 6000 pages – and that doesn’t include a ton of IRS regulations and associated case law. While simplification wouldn’t itself make the tax code more fair, it might make it more transparent. If people had better insights into the real winners and losers in the tax code, perhaps it could better inform their votes.

Completely Rethink Tax Incentives/Disincentives: To paraphrase Jim Croce, trying to direct the U.S. economy is akin to tugging on Superman’s cape. It might get his attention; it might not; it might just piss him off. That said, government can and should use tax policy to nudge things in preferred directions. While some laws and regulations are obviously required, tax incentives and disincentives can provide better motivations to encourage behaviors that benefit society… or at least increase tax revenues on less desirable behaviors. While we already do this, it’s not used nearly enough for the right reasons. In my perfect world, we would:

- Eliminate a ton of tax credits and deductions whose primary purpose is political. The Ethanol tax credit is an obvious target, but there are certainly others. The R&D tax credit, for example, encourages large companies to invest in research that makes them more money. Do they really need a tax break for that? If they do get one, the public at least needs to reap a large portion of the benefits.

- Implement a massive purge of charities, churches, and business organizations that can claim tax-exempt status. While there is a valid category of organizations that deserve a tax-exemption by serving a public good, taxpayers foot the bill for way too many organizations that fundamentally operate for private, political, or commercial purposes.

- Increase tax incentives to encourage retirement savings, clean energy usage, and higher education.

- Vastly expand the federal use of excise taxes. If a prevailing government wants to discourage a social behavior, then tax the crap out of it. Excise taxes on alcohol, tobacco, and firearms should be increased. Gambling and marijuana should be legalized and the government should collect excise taxes on these as well. Making things illegal adds law enforcement, court, and incarceration costs; making them legal and expensive adds tax revenue. Do the math.

Look for Cost Savings: As noted above, significant money likely won’t be found tweaking individual budget line items. That doesn’t mean we shouldn’t look for cost savings, though. Things can almost always be streamlined; fraud can almost always be reduced; some spending is almost always stupid. As long as the act of finding various cost savings doesn’t cost more than the amount saved, we should definitely try. We should even look into getting a better bang for our bucks in our social programs and the military – so long as we recognize these as core requirements worthy of our money.

Get Serious about Budget Neutrality: Every spending proposal should be accompanied by a corresponding income proposal. A ton of legislation claims it will be “budget neutral” by assuming purely magical economic benefits. The CBO has historically done a decent job scoring such proposals when given a decent chance, but those scores are often ignored. While keeping the CBO non-political is likely to be tough in the current environment, it is essential.

Increase Tax Rates: Yes, I saved this for last. I guess it’s pretty obvious that I’m not running for elective office since, in our current environment, this statement would be political suicide. Note, however, that I’m not looking for an overnight solution. Trying to quickly eliminate our federal deficit would ruin our economy and make the situation much worse. All we need is a plan that moves us in the right direction. Even if we implement most of the above suggestions, it simply won’t be enough. At some point we’ll need to suck it up and agree to pay for all the things we buy and also start paying down the debt incurred on things we’ve already bought. We can’t just keep passing along ever-increasing debt to future generations. A good start for now would be to reduce the Trump tax cuts and direct the vast majority of the added federal revenue to deficit reduction.